Emtrain’s 2024 GABC course is not only crafted by leading attorneys in the Anti-Corruption and FCPA field, but the highly engaging content includes employee pulsing surveys that help identify high risk areas within your organization.

Our 2024 Global Anti-Bribery & Corruption and FCPA training course is developed in partnership with Winston Chan, a partner at Gibson, Dunn & Crutcher LLC, distinguished for their work in the Foreign Corrupt Practices Act (FCPA) area.

All of Emtrain’s compliance and culture training courses are co-authored by industry experts, including global law firm partners, professors, former government regulators, and workplace professionals.

Partner

Gibson, Dunn & Crutcher’s

San Francisco Office

FCPA & Anti-Bribery Expert

Winston Y. Chan leads matters involving government enforcement defense, internal investigations and compliance counseling, and regularly represents clients before and in litigation against federal, state and local agencies, including the U.S. Department of Justice, Securities and Exchange Commission, and State Attorneys General.

Winston is a Chambers-ranked attorney in the category of White Collar Crime and Government Investigations, and Benchmark Litigation recognizes him as a Litigation Star for being “recommended consistently as a reputable and effective litigator by clients and peers.”

Get a preview of our industry-leading Anti-Bribery & Corruption training video content that dives deep into the complex social issues of our time.

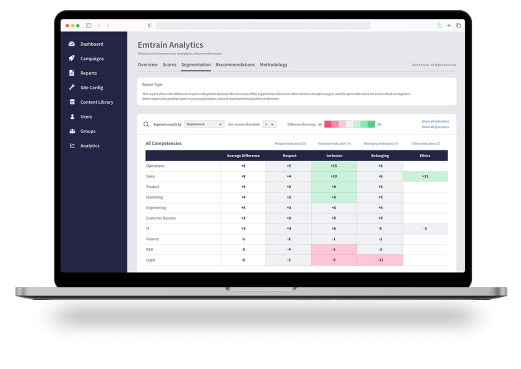

We measure employee responses to depictions of ethical dilemmas, so you can identify high risk departments and topics, and hone in on skills that require further development.

Operationalize your data by rolling out targeted training. Deploy data driven content recommendations and management actions that can curtail risk.

Regular content refreshers not only drive home key learning goals, but allow compliance leaders to quantify improvements in skills and risk mitigation over time.

Emtrain’s Ask the Expert feature enables users to ask questions about compliance, bias, harassment, and inclusion as they come up. It’s all confidential, and answers are sent straight to their inbox.

Bribery and corruption aren’t just risks for governments or multinational corporations. They’re issues that can affect any workplace, in any...

Anti bribery policies are a crucial part of any organization’s code of conduct. Bribery—whether it’s a gift, favor, or kickback—creates...

In January 2024, SAP found itself at the center of a significant FCPA violation lawsuit, resulting in a $100 million...

Recently, 70 current and former employees of the New York City Housing Authority (NYCHA) were charged with extortion and bribery,...

A global anti-bribery and corruption policy is crucial for maintaining compliance and upholding business ethics. These policies aim to prevent...

The threat of bribery and corruption looms large over businesses of all sizes and sectors. With increasing globalization, the risks...