Home » Concepts » Ethics & Compliance » OFAC (Office of Foreign Assets Control)

The Office of Foreign Assets Control (OFAC) is a branch of the U.S. Department of the Treasury that enforces economic and trade sanctions in the interest of national security. Businesses must be aware of who they can legally work with, where transactions occur, and the compliance risks of violating OFAC regulations. Understanding OFAC is critical for maintaining ethical partnerships and avoiding legal and reputational consequences.

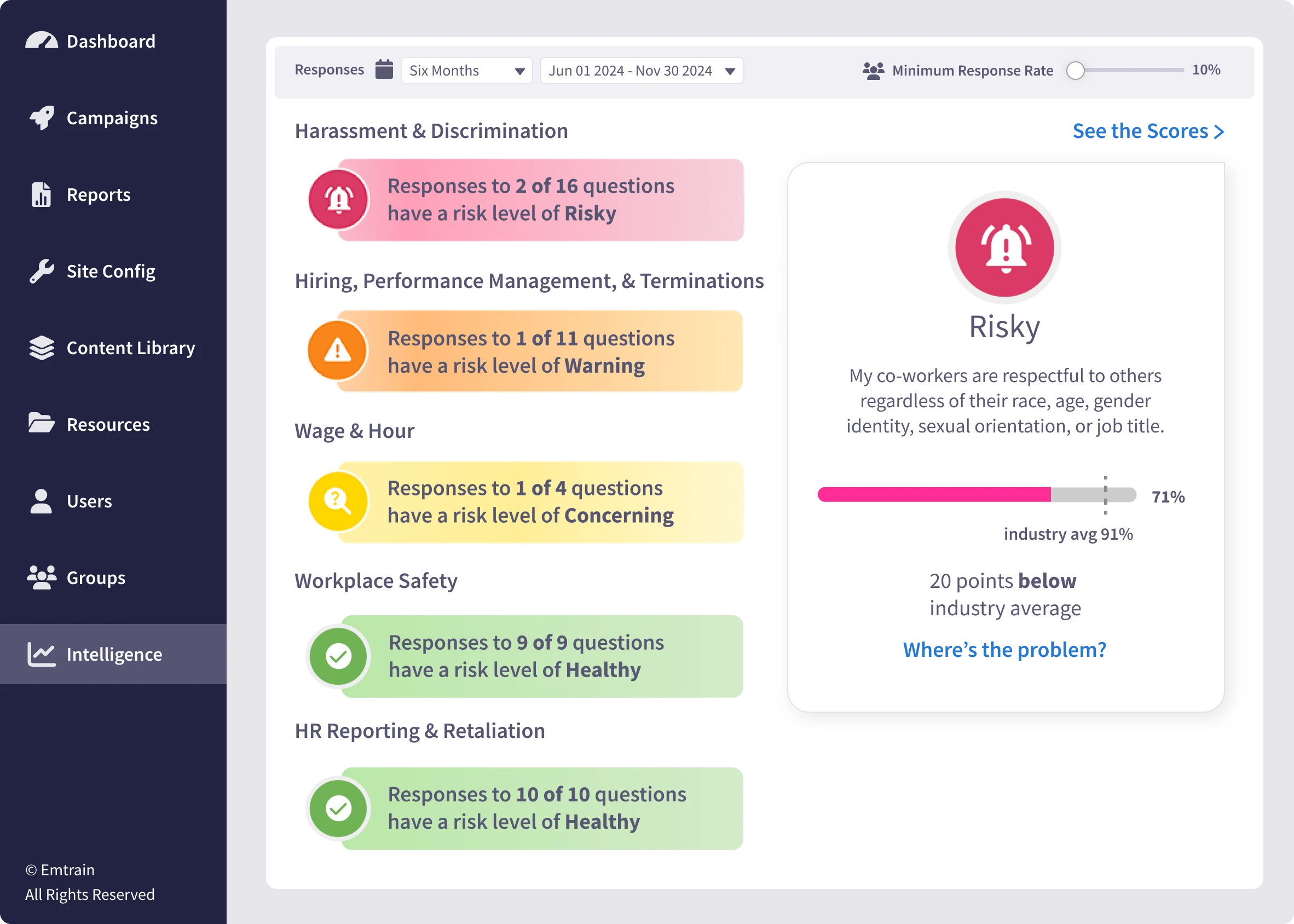

Emtrain’s harassment training course is engaging, interactive, and designed to spot and reduce EEO risk.

The Office of Foreign Assets Control (OFAC) was established during World War II under the U.S. Treasury to combat threats to national security. Its early role included blocking assets of enemy nations and individuals. Over the decades, OFAC evolved into a critical enforcement agency, administering economic and trade sanctions against countries, entities, and individuals involved in terrorism, nuclear proliferation, human rights abuses, cyberattacks, and more.

Today, OFAC sanctions reflect a global compliance obligation—with businesses expected to avoid financial or trade relationships that violate U.S. foreign policy or national security interests.

In a global economy where companies rely on complex vendor and supplier networks, OFAC ensures that U.S. entities avoid doing business with sanctioned individuals, groups, or countries. Non-compliance can result in fines, loss of federal contracts, and serious brand damage. This makes OFAC a foundational compliance concern for ethics, trade, and accountability.

OFAC enforces trade sanctions to support U.S. foreign policy and national security goals.

Sanctioned lists include individuals, companies, and entire countries—many tied to terrorism, human rights violations, or financial crimes.

Companies must screen all transactions and relationships to ensure they’re not inadvertently working with restricted parties.

Violations must be self-reported or risk even greater penalties if uncovered during investigation.

OFAC compliance reflects leadership’s commitment to ethical business practices and geopolitical responsibility.

While OFAC is a federal body, many states expect regulated industries—like finance, tech, and defense—to go above and beyond minimum compliance. Financial institutions may face dual reporting requirements, and companies with international operations often have internal compliance teams that monitor OFAC alerts in real-time.

Global Trade Disputes and Their Resolutions

Explore how organizations can resolve trade-related conflicts through legal channels and diplomatic processes—critical for teams working with global partners and needing a framework for action during sanctions disputes.

Global Trade Regulations and Laws

Understand the complex network of laws that govern cross-border transactions, including OFAC’s role in enforcing sanctions against specific countries, companies, and individuals.

Global Trade Violations and How to Prevent Them

Learn how unintentional violations occur and what proactive measures teams can take to prevent costly compliance failures—from due diligence to vendor screening and employee training.

Two employees review suspicious financial records and identify transactions involving entities from restricted regions. They escalate the concern as a red flag to senior compliance officers, demonstrating how internal vigilance plays a crucial role in OFAC compliance and protecting the company from potential violations.

This scenario illustrates:

The importance of employee awareness of restricted lists and high-risk territories

The value of speaking up when something doesn’t look right—even if it’s outside your department’s scope