Home » Concepts » Ethics & Compliance » Suspicious Activity

Suspicious activity refers to any behavior, transaction, or pattern that appears out of the ordinary and may indicate potential fraud, money laundering, or other criminal activity. Organizations are required by law to detect, investigate, and report suspicious activity to help prevent financial crimes and ensure regulatory compliance.

Examples of suspicious activity include unusually large cash transactions, reluctance to provide identification, transactions just below reporting thresholds, frequent transfers between unrelated accounts, or complex business structures with unclear purposes.

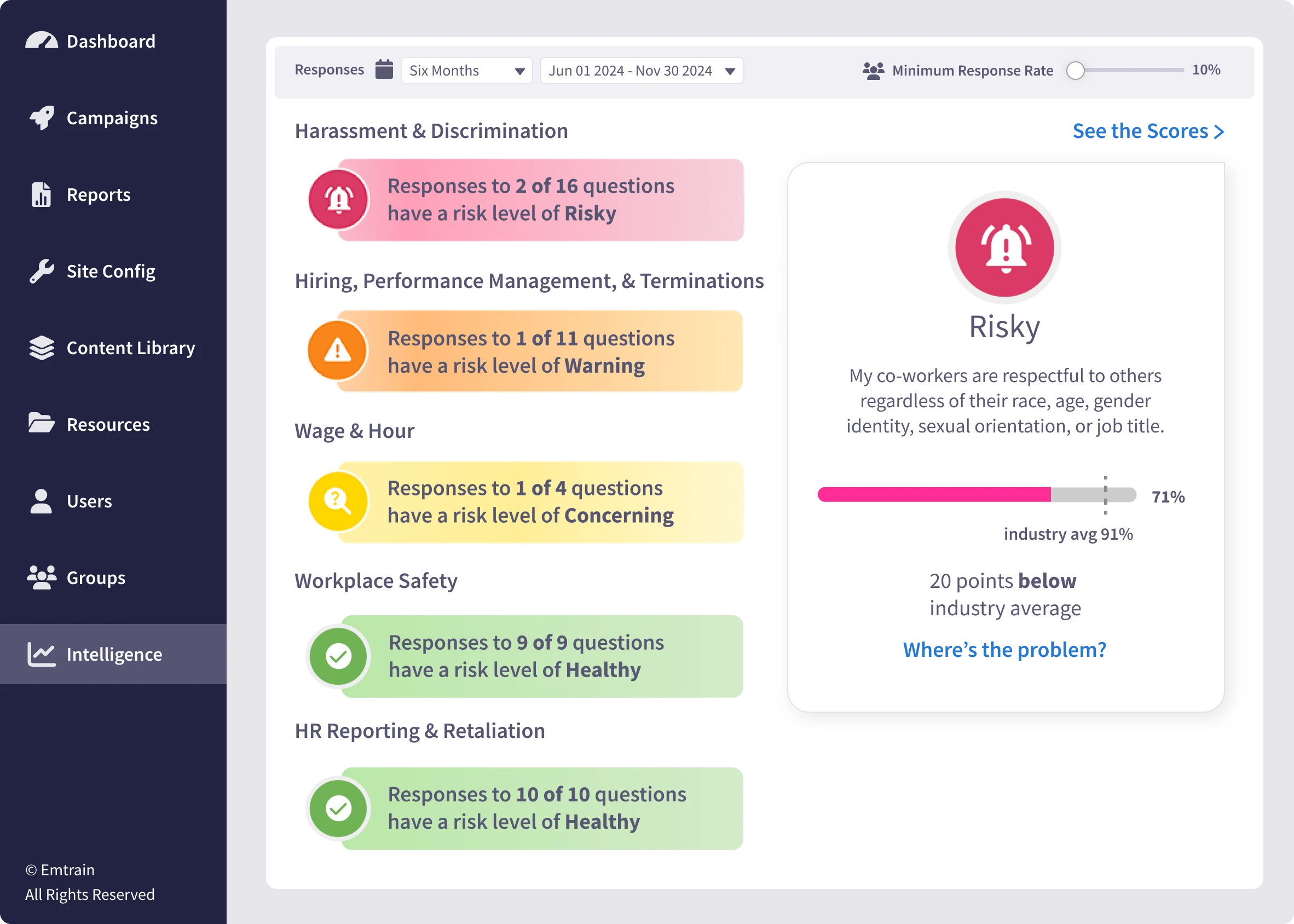

Emtrain’s harassment training course is engaging, interactive, and designed to spot and reduce EEO risk.

Suspicious activity is any transaction, pattern, or behavior that does not fit the expected profile of a customer, employee, or business operation. It may indicate fraud, money laundering, theft, bribery, or other forms of misconduct. Detecting suspicious activity is critical for regulatory compliance and helps protect your organization from financial and reputational harm.

Unusually Large Transactions: Employees or customers making cash payments or transfers far outside typical amounts for your business.

Multiple Small Payments: A series of smaller transactions designed to avoid detection or reporting thresholds (a practice known as “structuring”).

Evasive or Incomplete Answers: Customers, vendors, or colleagues who avoid providing identification, business purpose, or other required information.

Sudden Changes in Behavior: Employees suddenly accessing files or accounts outside their normal duties, or working unusual hours.

Unexplained Wealth or Lifestyle: Colleagues displaying spending habits inconsistent with their known income.

Transactions with High-Risk Jurisdictions: Payments to or from countries known for lax financial controls or high corruption.

Complex Company Structures: Use of shell companies, third-party intermediaries, or convoluted chains of ownership.

Pressure to Bypass Controls: Requests from anyone—inside or outside the organization—to ignore established protocols or skip due diligence steps.

Establish Clear Policies: Ensure your organization has written policies and procedures for identifying, documenting, and reporting suspicious activity.

Educate Employees: Regularly train staff on red flags, reporting mechanisms, and the importance of vigilance.

Encourage a Speak-Up Culture: Make it easy and safe for employees to report suspicious activity, including through anonymous channels if possible.

Monitor and Audit Transactions: Use technology to track and flag unusual transactions or patterns for review.

Conduct Due Diligence: Verify the identity and legitimacy of customers, vendors, and partners through KYC (Know Your Customer) processes.

Maintain Records: Keep thorough and accurate records of all transactions, investigations, and reports as required by law.

Respond Promptly: Investigate all reports of suspicious activity swiftly and escalate issues to compliance or law enforcement authorities as necessary.

Regularly Review Procedures: Continuously assess and update your policies and controls to address new threats and regulatory changes.

Learn how to spot red flags and respond appropriately to suspicious activity in the workplace.