Protect Your Business with Anti-Money Laundering Awareness

A Message from Our CEO

Learn more about EmtrainCourse Description

Emtrain’s Anti-Money Laundering (AML) course equips learners with a clear understanding of how money laundering works, its broader impacts, and the laws designed to stop it. The course outlines Know Your Customer (KYC) requirements, explains how to identify red flags, and reinforces your organization’s policies for documentation and reporting. Learners gain practical skills to help prevent money laundering and support regulatory compliance.Key Concepts

- The definition and stages of money laundering

- KYC regulations and compliance frameworks

- Spotting red flags and suspicious behavior

- Internal policies, reporting obligations, and recordkeeping

Course Features

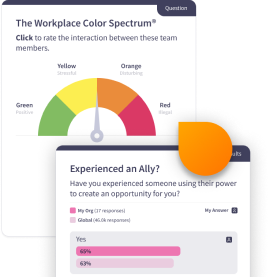

- Access to our Anonymous Ask the Expert tool

- Rich video scenarios based on real-world events

- Built-in employee sentiment surveys

- 50+ Machine Translation Options

- Optional program timer

- Policy acknowledgement tool

- Extensive customization options

Lessons

The Basics of Money Laundering

Know Your Customer (KYC)

Suspicious Activity and Red Flags

SARs, Record-Keeping, and Our Policy

Relevant Courses

Complementary Microlessons

Recommended Resources

From ‘Ask the Expert’

Emtrain’s Ask the Expert feature enables users to ask questions about compliance, bias, harassment, and diversity & inclusion as they come up. It’s all confidential, and answers are sent straight to their inbox. View some of the example questions below and see the Experts answers.

Q

What are common red flags that may indicate money laundering at work?

Thanks for asking. Some red flags include unusually large cash payments, customers who avoid normal record-keeping, transactions that don’t fit the business profile, or people moving money through multiple accounts with no clear purpose. One sign alone doesn’t prove laundering, but together they can raise concern.

Q

How should I report a suspicious financial transaction?

Great question. The first step is to follow your company’s reporting procedures — usually through your compliance officer, manager, or a dedicated reporting hotline. Don’t investigate on your own. Your role is to raise the concern so the right people can look into it properly.

Q

What is the difference between placement, layering, and integration in money laundering?

Good one. Placement is when illegal funds first enter the financial system, layering is when the money is moved around to make it harder to trace, and integration is when it re-enters the economy looking like legitimate funds. Knowing the stages helps employees recognize suspicious activity early.

Q

How can employees avoid unknowingly participating in money laundering?

Thanks for reaching out. The best way is to follow company policies closely — that means collecting proper identification, asking questions when transactions seem unusual, and never ignoring your instincts if something feels off. When in doubt, check with compliance before moving forward.

Q

What customer behaviors should raise AML compliance concerns?

Some warning signs include reluctance to provide identification, using multiple names or accounts, insisting on paying in cash when that’s not typical, or trying to structure transactions just under reporting thresholds. These patterns may suggest attempts to avoid detection.