Home » Concepts » Ethics & Compliance » FCPA (Foreign Corrupt Practices Act)

The Foreign Corrupt Practices Act (FCPA) is a United States federal law enacted in 1977 that prohibits individuals and companies from bribing foreign government officials to gain or retain business. The FCPA also mandates that publicly traded companies maintain accurate books and records and implement internal accounting controls to prevent and detect bribery. In short, the FCPA promotes ethical business practices and transparency in international commerce.

For an official overview, refer to the U.S. Department of Justice (DOJ) FCPA Resource Guide and the U.S. Securities and Exchange Commission (SEC) FCPA Enforcement Page.

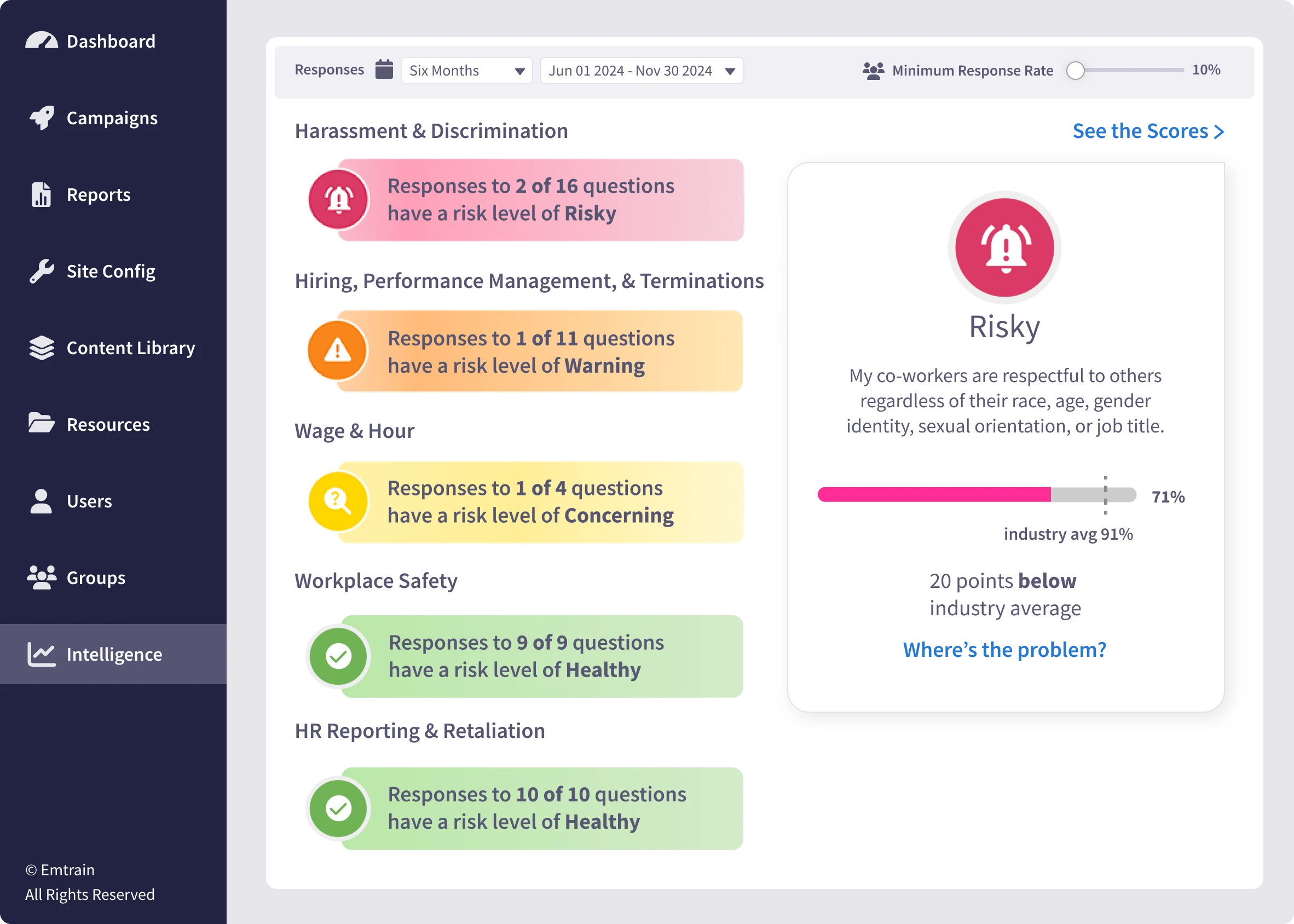

Emtrain’s harassment training course is engaging, interactive, and designed to spot and reduce EEO risk.

The Foreign Corrupt Practices Act (FCPA) is a cornerstone of global anti-bribery legislation. Enacted in 1977, the FCPA prohibits U.S. companies, citizens, and certain foreign issuers from offering or giving anything of value to foreign government officials to obtain or retain business. The law also mandates accurate recordkeeping and robust internal accounting controls. Together, these provisions set the foundation for ethical and transparent business conduct worldwide.

Emtrain’s Global Anti-Bribery and Corruption (FCPA) Training provides employees and leaders with practical tools to identify, prevent, and respond to potential FCPA violations. To further understand how these principles apply in real-world settings, explore Bribery and Corruption: How Compliance Programs Protect Organizations.

The FCPA arose out of post-Watergate investigations in the 1970s, when over 400 U.S. companies admitted to paying more than $300 million in questionable payments to foreign officials. These revelations undermined public confidence in corporate governance and global trade ethics. In response, Congress enacted the FCPA to restore trust and ensure a level playing field.

The act’s influence has been global. It inspired similar frameworks like the UK Bribery Act and the OECD Anti-Bribery Convention, making anti-corruption compliance a worldwide business standard. According to the U.S. Department of Justice (DOJ) and the Securities and Exchange Commission (SEC), FCPA enforcement continues to rise, with penalties in 2024 exceeding $2 billion across industries.

For a deeper look into modern enforcement trends, review SAP’s FCPA Violations: Global Anti-Bribery Compliance for case-based insights.

Example 1: The Third-Party Agent

A sales director authorizes a consultant to “facilitate” a deal in another country. Months later, it’s discovered the consultant paid bribes to secure the contract. Under the FCPA, both the company and the director may face liability for indirect payments made through intermediaries.

Example 2: The Gift That Crossed the Line

A procurement manager in Asia receives a luxury watch from a supplier. Though the gift seems harmless, it violates both company policy and FCPA guidelines, exposing the organization to risk.

Example 3: The Misclassified Expense

A regional finance team records a bribe as a “marketing expense.” This misrepresentation breaches the FCPA’s books and records provisions, which require transparent, accurate accounting.

For insights into how workplace culture influences compliance, explore Anti-Bribery and Corruption Policy in the Workplace: Guide, which details key elements of effective policy design and enforcement.

Addressing FCPA risks begins with fostering a culture where ethical decisions are expected and supported. Employees should feel empowered to ask questions, report concerns, and challenge questionable practices.

If a potential violation arises:

The Global Anti-Bribery and FCPA Compliance Checklist offers a practical roadmap for HR and compliance teams to assess their current programs and close any policy gaps. For context, read The Biggest Ethics and Compliance Scandal in 100 Years to see how corporate culture failures can lead to global enforcement actions.

According to the U.S. Government Accountability Office (GAO), organizations with strong anti-corruption controls experience 25–35% fewer misconduct incidents and improved trust in leadership.

Preparing for FCPA-related situations involves embedding compliance into daily decisions. Key steps include:

These efforts align with the OECD’s 2021 Anti-Bribery Recommendations, which highlight tone from the top and risk-based monitoring as critical success factors.

Learn from real-world lessons shared in Anti-Bribery and Corruption: The NYCHA Extortion Charges to understand how lapses in oversight can escalate into enforcement issues.

The DOJ’s Evaluation of Corporate Compliance Programs (2023) notes that effective organizations “operationalize compliance”—meaning ethics are built into everyday processes, not bolted on as an afterthought.

Anti-bribery compliance is not just a legal mandate—it’s a leadership commitment to integrity and fairness. Organizations that embed these values into their culture not only reduce regulatory risk but also strengthen stakeholder trust and brand resilience. Through Emtrain’s learning solutions and resources, leaders can build transparent, accountable workplaces that uphold the highest global standards of ethics.

When conducting business abroad, companies must remain vigilant in navigating local customs and laws while adhering to global anti-bribery standards. A seemingly harmless gesture, such as treating government officials to a 5-star dinner, can easily blur the lines between hospitality and bribery.