Learn to Identify Material, Non-public, Inside Information

Course Video Preview

Sharing non-public information about a company mergerInsider trading is a crime—and a serious threat to the operation, reputation, and culture of your organization. From a financial perspective, insider trading represents a legal risk with the potential for significant fines and penalties, the loss of important leaders in the organization who may be fired or imprisoned, and lengthy, disruptive, and expensive investigations.

From a cultural perspective, insider trading reflects a clear conflict of interest and a willingness to get ahead at the expense of the company and other employees. It feeds the narrative that your organization is being managed and manipulated by a small group of insiders for their own benefit—and undercuts worker commitment and performance.

This Course helps learners understand the basics of insider trading, how to avoid missteps that may not be intuitive to frontline managers and employees, and highlights the potential for personal and organizational penalties for insider trading violations.

Course DescriptionInsider Trading is designed for corporate executives, service professionals (law, finance, accounting), and all people with access to business information that is not easily available to the general investing public. Our expert is Tim Crudo, former Assistant US Attorney in San Francisco, who was responsible for several high profile prosecutions of company executives for insider trading.

This Insider Trading training course covers:

- how to identify "material, non-public, inside information"

- the risk posed by expert networks

- when "advice" crosses the line into non-public "inside" information

This Insider Trading Training course also gives learners direct access to Emtrain’s course experts and can confidentially ask questions via our innovative Expert Q&A feature.

Key Concepts- What is "inside information?"

- Where do people get inside information?

- What is a duty of trust?

- The basics of tipping.

- How tipping happens and can lead to trouble for friends and family.

- How mishandling confidential information can lead to enterprise risk, even if the conduct does not amount to insider trading.

- The rules around trading windows.

- Information about organizational policies and restrictions.

Course Features

- Access to our Anonymous Ask the Expert tool

- Rich video scenarios based on real-world events

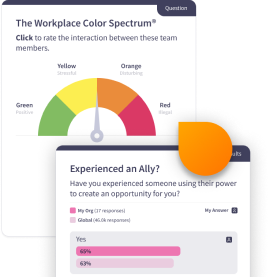

- Built-in employee sentiment surveys

- 50+ Machine Translation Options

- Optional program timer

- Policy acknowledgement tool

- Extensive customization options

Lessons

An Overview of Insider Trading

What Is "Inside Information"?

Sources of Inside Information

Breaching a Duty

The Basics of Tipping

Accidental Tipping

The Hot Tip

Related Offenses

Trading Windows

Summary Quiz

Reporting Questions and Policies

Post-Program Survey

What is Insider Trading training?

Insider trading training teaches employees how to identify what information is private to the business (inside information) and practices in order to prevent penalties such as getting fined or even sentenced to prison.

Relevant Courses

Complementary Microlessons

Recommended Resources

From ‘Ask the Expert’

Emtrain’s Ask the Expert feature enables users to ask questions about compliance, bias, harassment, and diversity & inclusion as they come up. It’s all confidential, and answers are sent straight to their inbox. View some of the example questions below and see the Experts answers.