Home » Concepts » Ethics & Compliance » Point-of-Sale (POS)

A Point-of-Sale (POS) system is the central hub where businesses complete customer transactions. It typically includes a payment terminal, computer, or tablet that captures, processes, and transmits sensitive cardholder data. Because POS systems store and transmit financial information, they are frequent targets for cybercriminals seeking to steal credit card data or personal details. Securing these systems is a core part of compliance with the Payment Card Industry Data Security Standard (PCI DSS).

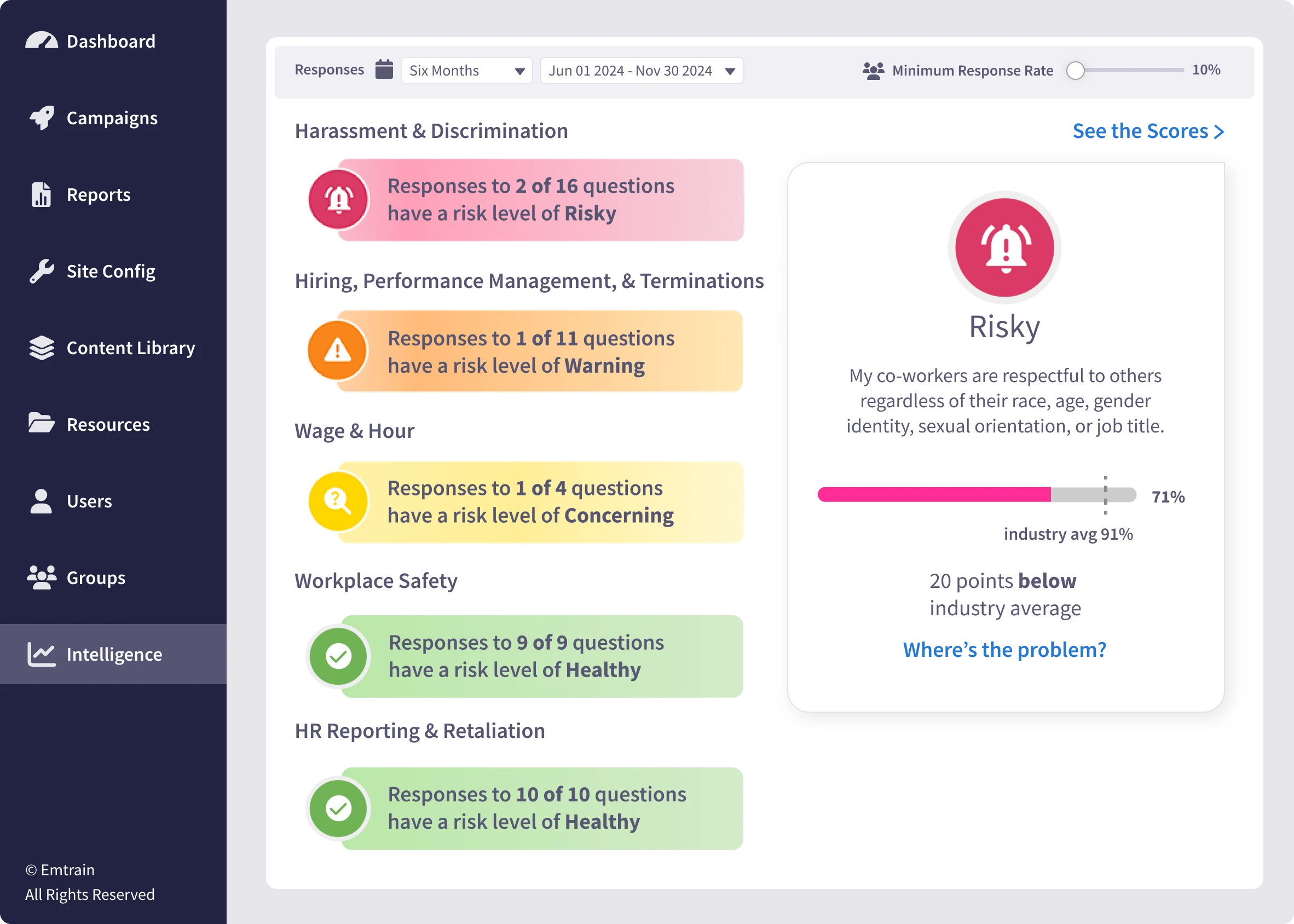

Emtrain’s harassment training course is engaging, interactive, and designed to spot and reduce EEO risk.

The first cash registers appeared in the late 1800s, designed simply to prevent employee theft. By the 1970s, digital POS systems began automating payment and inventory processes. Today, cloud-based POS systems integrate with customer databases, e-commerce platforms, and mobile wallets. While this interconnectivity increases efficiency, it also expands risk exposure.

Major breaches such as the 2013 Target POS malware attack, which compromised over 40 million credit and debit card accounts, demonstrate the stakes. Every organization that processes card data—whether a small retailer or a global enterprise—must maintain PCI DSS compliance to protect its customers and its reputation.

Scenario 1: A retail associate notices transactions lagging on a POS terminal. IT later discovers that a keylogger had been installed via a phishing email, capturing every card swipe for weeks.

Scenario 2: A restaurant experiences a system outage, and a server starts writing down card details to complete payments. Though well-intentioned, this violates PCI DSS standards and leads to a reportable data breach.

Scenario 3: A manager delays installing a security patch because it’s a busy day. Days later, the company discovers a breach through a known vulnerability that the patch would have fixed.

These examples highlight that security lapses are often human lapses—a reason why People Leaders and HR Managers must prioritize awareness and training, not just technology.

Additional resources:

For HR Managers, the risk isn’t just technical—it’s cultural. Employee awareness determines whether compliance controls succeed or fail. Compliance Officers must ensure that PCI DSS policies are understood and followed daily. People Leaders must foster a culture of responsibility where every employee understands the impact of mishandling payment data. Emtrain’s platform bridges these needs with engaging, expert-led microlessons that align behavior with compliance.

A secure POS system protects more than credit card data—it safeguards your company’s brand, trust, and financial stability. Compliance isn’t a one-time checklist; it’s a shared, ongoing commitment. With Emtrain’s PCI DSS microlesson, HR and Compliance teams can equip employees to recognize red flags, apply best practices, and uphold a security-first culture that meets industry standards.

No video ID provided.