Understanding the Failure to Prevent Fraud Law

The UK’s Failure to Prevent Fraud (FTPF) law makes it a criminal offence for organisations to fail to prevent fraud committed by employees or associates for the company’s benefit. This microlesson helps employees understand how FTPF applies to their role, why there is no such thing as “small fraud,” and how every individual’s actions contribute to the organisation’s legal exposure. By learning to recognise red flags, follow reporting procedures, and uphold integrity, teams help maintain a culture of compliance, accountability, and trust.

Microlesson Description

This essential microlesson provides an overview of the UK’s new Failure to Prevent Fraud (FTPF) law and explains how a company can be held criminally liable if an employee commits fraud. It reinforces that every employee plays a crucial role in preventing fraud and that the company’s only defence is to have adequate preventative procedures in place. Learners will understand their personal responsibility in maintaining integrity and protecting the organisation from legal, financial, and reputational risk.

Key Concepts

- Understand how the UK’s Failure to Prevent Fraud (FTPF) law holds organisations criminally liable for failing to prevent fraud by employees or associates

- Recognise that there is no “small fraud” — any act of dishonesty can expose the organisation to prosecution

- Learn how adequate preventative procedures serve as the company’s primary legal defence

- Identify common fraud risks, understand personal accountability, and know how and when to report concerns

Microlesson Features

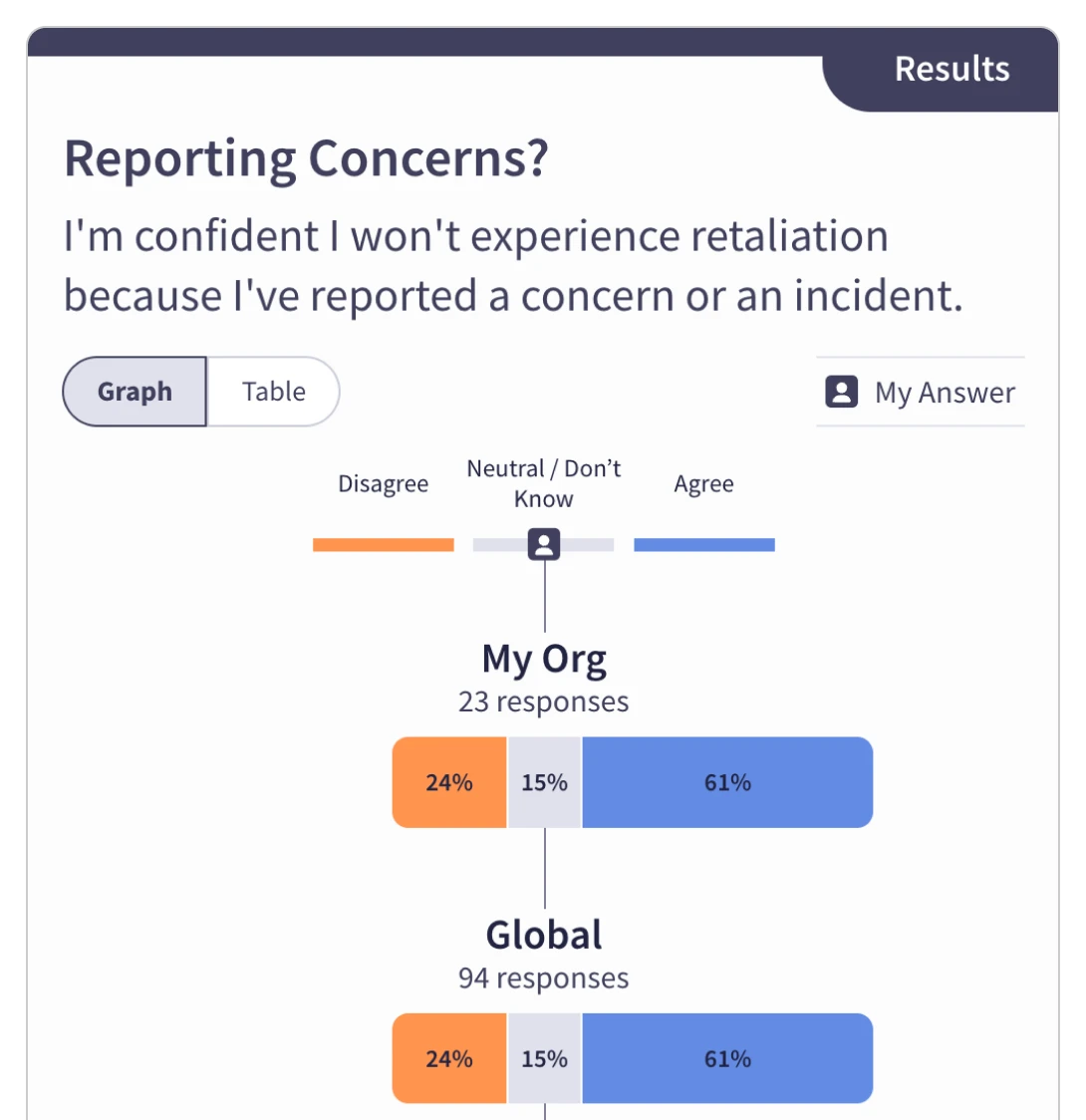

- Employee sentiment pulsing questions that provide leaders with insights into their workforce's core cultural competencies

- Emtrain's Expert Answers tool, enabling employeees to submit anonymous questions about sensitive issues.

- Rich, contemporary video scences illustrating key concepts through realistic scenarios

- A data driven, skill-based approach to eLearning that establishes a shared language for employees.

Related Resources

Related Trainings

Frequently Asked Questions

Below are answers to common questions that employees and managers have about this topic. These FAQs provide a preview of what you’ll learn in this microlesson and why it matters.