Home » Concepts » Ethics & Compliance » FTPF (Failure to Prevent Fraud)

The UK’s Failure to Prevent Fraud (FTPF) law establishes a corporate criminal offence for organisations that fail to stop employees or associates from committing fraud for their benefit. It applies across all industries and signals a major shift in global compliance expectations. The FTPF framework places legal responsibility squarely on leadership to ensure “adequate prevention procedures” are in place. In other words, if fraud happens, the organisation—not just the individual—is liable unless it can prove it took reasonable steps to prevent it.

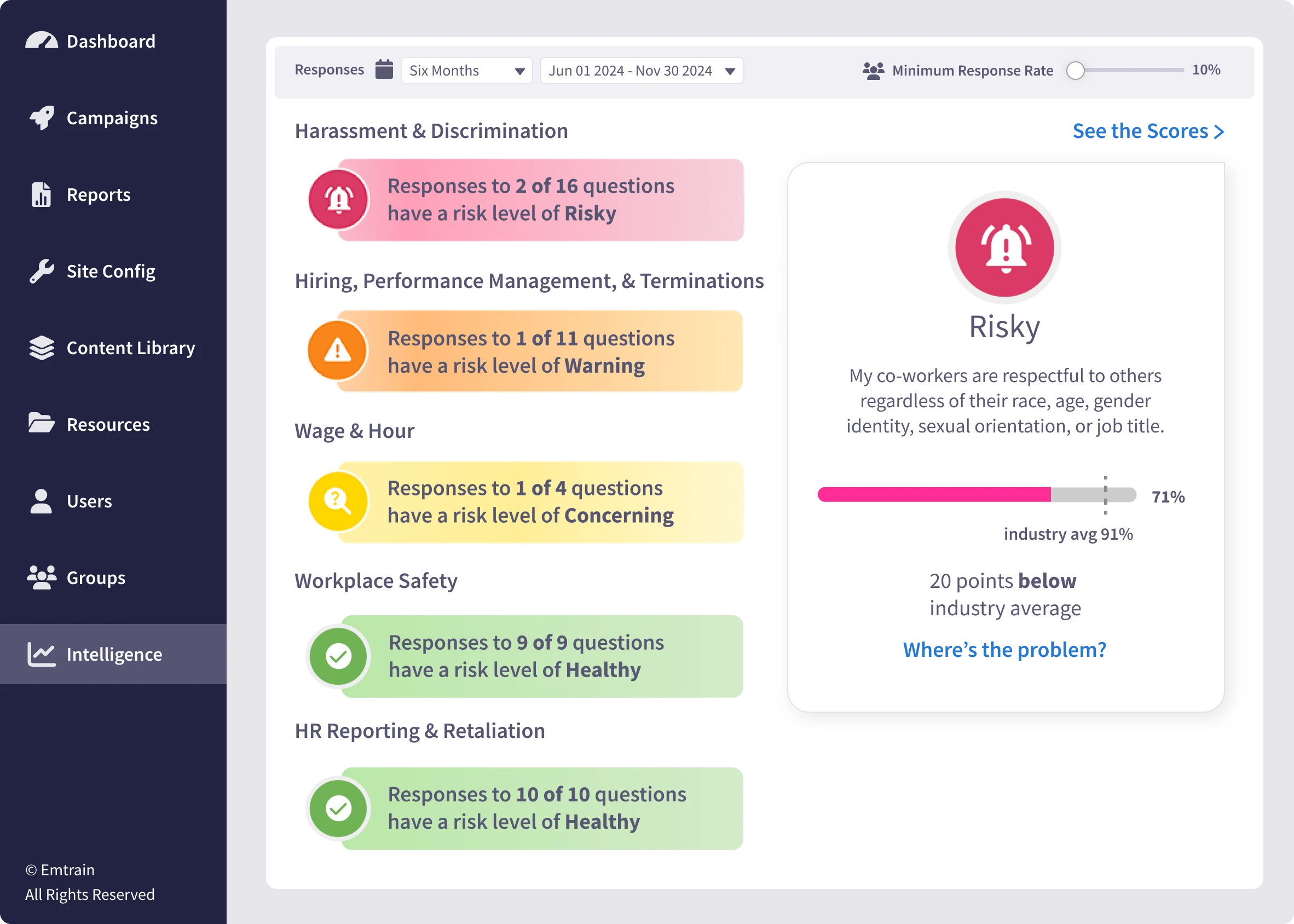

Emtrain’s harassment training course is engaging, interactive, and designed to spot and reduce EEO risk.

The FTPF law evolved from the UK Bribery Act 2010 and reflects the growing global trend of corporate accountability. High-profile scandals—from Enron to Wirecard—showed that poor governance and weak internal controls can devastate not only a company but also the broader economy. In response, regulators expanded liability to prevent companies from turning a blind eye to misconduct.

In 2023, the Economic Crime and Corporate Transparency Act introduced FTPF, underscoring that ethical leadership is no longer optional—it’s required. This aligns closely with Emtrain’s belief that ethics and compliance are not just checkboxes but culture-driven competencies that shape organisational trust.

Fraud often hides in plain sight—through everyday shortcuts, rationalisations, and overlooked “minor” infractions. These real-world examples illustrate the importance of proactive prevention:

Each example underscores a critical lesson: there is no such thing as “small fraud.” Every act of dishonesty erodes trust, damages culture, and can expose your organisation to prosecution.

Solution: Train your employees skills to prevent false expenses with Emtrain’s Microlesson on Bribery and Expense Reports

For HR managers, compliance officers, and people leaders, the FTPF standard is both a challenge and an opportunity. It demands a holistic approach to ethical culture, compliance training, and accountability.

Building resilience against fraud requires more than policies—it requires consistent culture reinforcement.

External resource: U.S. Department of Justice – Evaluation of Corporate Compliance Programs

Failure to Prevent Fraud (FTPF) isn’t just a compliance requirement—it’s a wake-up call for ethical leadership. The law formalises what many organisations already know: fraud prevention starts with culture. By combining legal diligence with people-first compliance, companies can transform accountability from a burden into a strategic advantage.

Emtrain’s Failure to Prevent Fraud (FTPF) Microlesson brings this concept to life, helping learners see their role in safeguarding the organisation from fraud and reinforcing that every act of honesty strengthens the workplace. Through Emtrain’s integrated training and intelligence tools, you can build a culture that doesn’t just prevent fraud—it prevents reputational, financial, and ethical collapse.

A woman sales representative is about to close a major deal when her client suggests they meet for dinner to finalize the contract, adding, “You can just expense it.” She hesitates—her husband dislikes nighttime business meetings—and politely declines, offering instead to send the statement of work and meet at his office the next day. Later, she discusses the situation with her sales manager. The manager, focused on closing the deal, suggests she take the client out for a drink to move things along. She explains that the client has been overly forward with her, making her uncomfortable. The manager acknowledges that the client’s behavior is inappropriate but, instead of addressing the issue directly, quietly reassigns the deal to another colleague. The rep is left in disbelief, losing her biggest client because she chose integrity over pressure.

This scene highlights how management decisions made in “good faith” can still perpetuate ethical blind spots, undermining fairness, culture, and trust. It’s a reminder that compliance isn’t just about following the law—it’s about standing up for integrity and preventing silent misconduct that can damage both individuals and the organisation’s reputation.